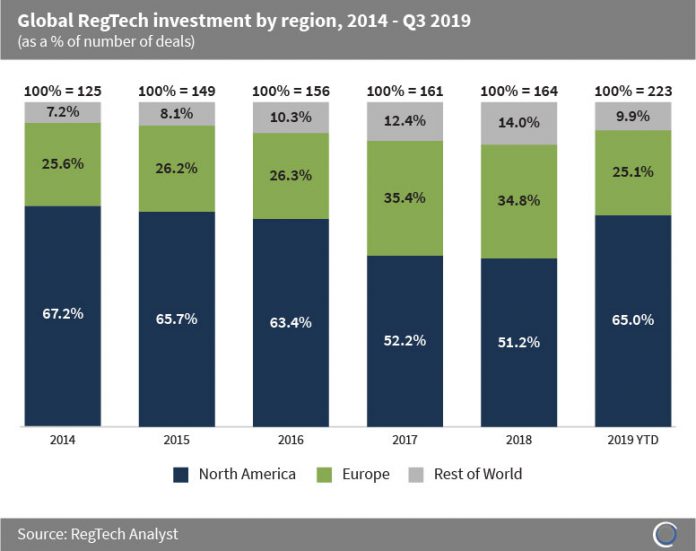

There was a shift in the concentration of global RegTech deal activity from North America to other regions of the world between 2014 and 2018. Although North America has dominated the global RegTech landscape with 594 transactions completed between 2014 and Q3 2019, the region saw its share of total deal activity drop from 67.2% in 2014 to just over half of all deals 2018.

However, the proportion of deal activity involving companies in North America rebounded this year, accounting for almost two thirds of transactions in the first three quarters of 2019.

Prior to 2016, the ‘Rest of World’ category was defined purely by Israel, Australasia and Asia, however, three RegTech companies in Africa; ThisIsMe, DocFox and Intergreatme raised capital in May 2016, May 2019 and June 2019, respectively.

Israeli RegTech companies captured 4.3% of global RegTech deal activity between 2014 and Q3 2019, with $543.2m raised across these deals during the period. Aqua Security is a cybersecurity and compliance solutions provider based in Tel Aviv. The company raised $62m in a Series C round led by Insight Partners in April 2019, which is the largest RegTech deal in Israel to date.

Copyright © 2018 RegTech Analyst