CyberTech investment activity set a record pace in Q1 2020 lifted by large deals over $75m

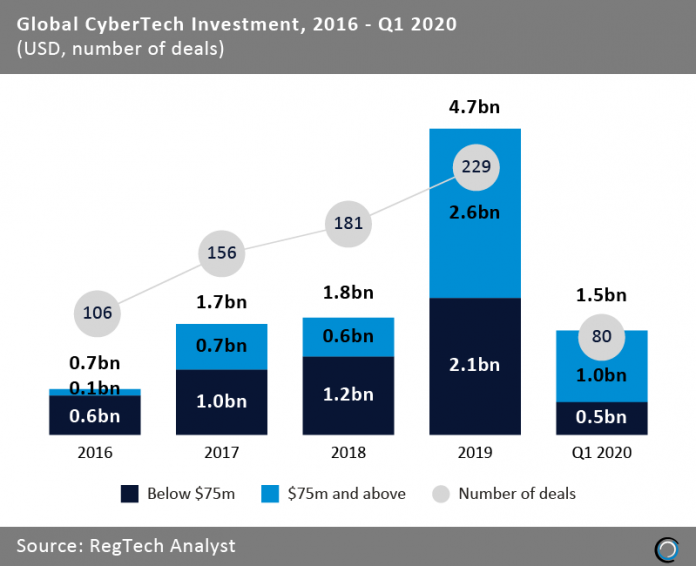

The global CyberTech industry experienced tremendous growth between 2016 and 2019 as investors poured money into companies battling the increased threat of cyber attacks and data leak in financial services. Total funding grew at a CAGR of 91.6% from $666.1m to nearly $4.7bn at the end of last year.

Increased share of total funding came from deals over $75m hitting 55.3% in 2019. However, capital invested and deal numbers also grew for transactions under that threshold. This demonstrates that the sector experienced healthy growth not just fuelled by larger cheques written by investors.

Deal activity also increased during the period from 106 transactions in 2016 to 229 funding rounds in 2019 as innovation in the sector spread to other regions in the world and new cybersecurity threats emerged.

CyberTech investment had a strong start to 2020 with $1.5bn worth of funding raised across 80 deals. The funding was driven by large deals over $75m which made up 73.3% of the total capital raised during the quarter. Deal activity grew 90.4% compared to Q1 2019 putting CyberTech funding on track for a record year, depending on the impact of the Covid-19 pandemic.

We recently announced the CyberTech100 list for 2020. If you want to learn more about the most innovative companies bolstering the defenses of financial institutions download our report at www.CyberTech100.com.

The data for this research was taken from the RegTech Analyst database. More in-depth data and analytics on investments and companies across all RegTech and CyberTech sectors and regions around the world are available to subscribers of RegTech Analyst.

Copyright © 2018 RegTech Analyst