CyberTech and Information Security companies’ fundraising activity was the main driver behind the strong investment levels recorded in the RegTech industry globally the first quarter of 2020.

As reported previously it seems the coronavirus pandemic had little impact on investors’ appetite in the RegTech market as funding reached nearly $2.4bn in the first three months of 2020, a 3.8x increase compared to the same period last year.

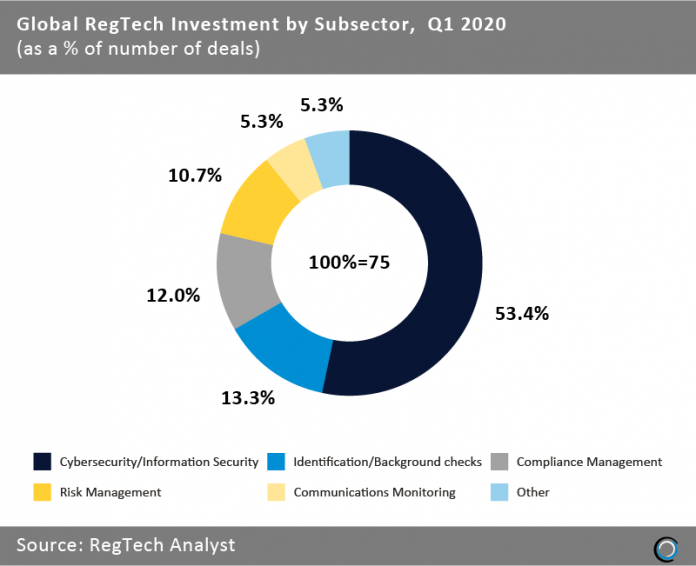

Cybersecurity/Information Security companies completed 40 deals or 53.4% of all RegTech deals globally in the opening three months of 2020 as financial services companies continue to move towards digital operations and expand their security budgets. The largest deal of the period was raised by Netskope, a software provider helping companies secure data and protect against threats in cloud applications, which raised $340m in a Series G round in February.

Identification/Background checks companies collected the second highest number of deals with ten funding rounds completed in the first quarter of 2020. Investors are keen to back companies in the subsector as the global digital identity solutions market size is projected to grow from $13.7bn in 2019 to $30.5bn by 2024, according to a research by ResearchAndMarkets.com. Proxy, a smartphone-enabled digital identity provider, raised $42m in a Series B round in March, which was the largest transaction in the subsector in Q1.

RegTech Analyst platform subscribers can check the full data behind investment activity in all RegTech subsectors.

Not a subscriber? Contact us today

Copyright © 2018 RegTech Analyst