There were almost 1,000 RegTech deals completed globally between 2014 and Q3 2019, with $16.1bn raised across these transactions.

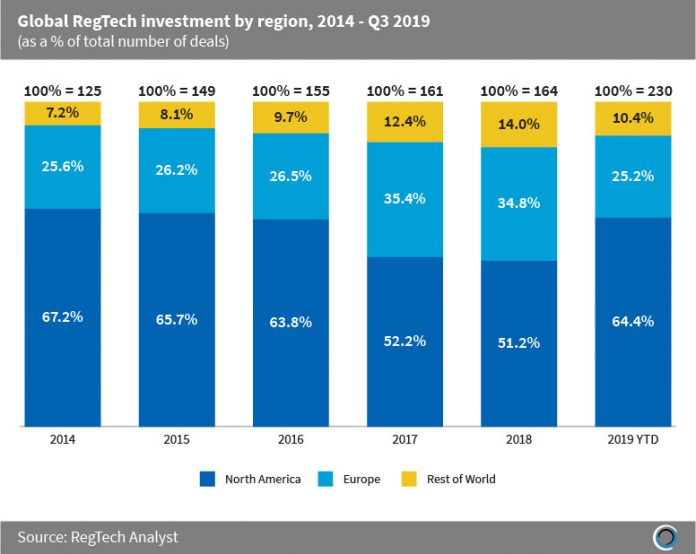

North American companies have dominated the global RegTech landscape, having captured more than 60% of all RegTech deals since 2014. There was a shift in the concentration of transactions from North America to Europe between 2014 and 2018, as RegTechs and investors geared up for Eurocentric regulations such as MiFID II and GDPR that were soon to be implemented.

However, the trend in the proportion of deal activity has involving companies in North America reversed this year, accounting for almost two thirds of transactions in the first three quarters of 2019, with a slew of cyber deals as investors look to front run GDPR-like regulations reaching the US.

Deals popping up in other parts of the world, with the share of deals occurring outside of North America and Europe peaking at 14% last year. Sao Paulo-based IDwall provides document and identity verification solutions to Brazilian SMEs and raised $3m from Monashes in March 2018, which was the largest RegTech deal in South America last year.

Copyright © 2018 RegTech Analyst