New York-based financial services application developer Beacon Platform has closed its Series A round led by PIMCO.

Participation to the round also came from Barclays, and Global Atlantic Financial Group.

Launched in 2014, builds a range of infrastructure and front office applications for the financial services industry. Its client base includes global investment banks, asset managers, insurance companies, and commodities trading firms.

Beacon Core enables institutions to utilise analytics and application building tools to help drive revenue, while Beacon Standard provides tools for market conventions, instruments, trade life cycle events, risk, and PnL analytics.

Barclays global head of distribution and structuring Guy Saidenberg said, “Work to date conducted by our developers and data scientists has demonstrated significant potential for the platform. We look forward to helping further improve these tools as the ability to leverage data and digital assets becomes increasingly important in the financial services industry,”

Last month, Barclays partnered with MarketInvoice to ease the access to credit for UK SMEs. As part of the deal, Barclays picked up a ‘significant’ minority stake in the digital invoice financing company. The bank completed the deal to support its new investment plan and to help it create its own invoice financing solution.

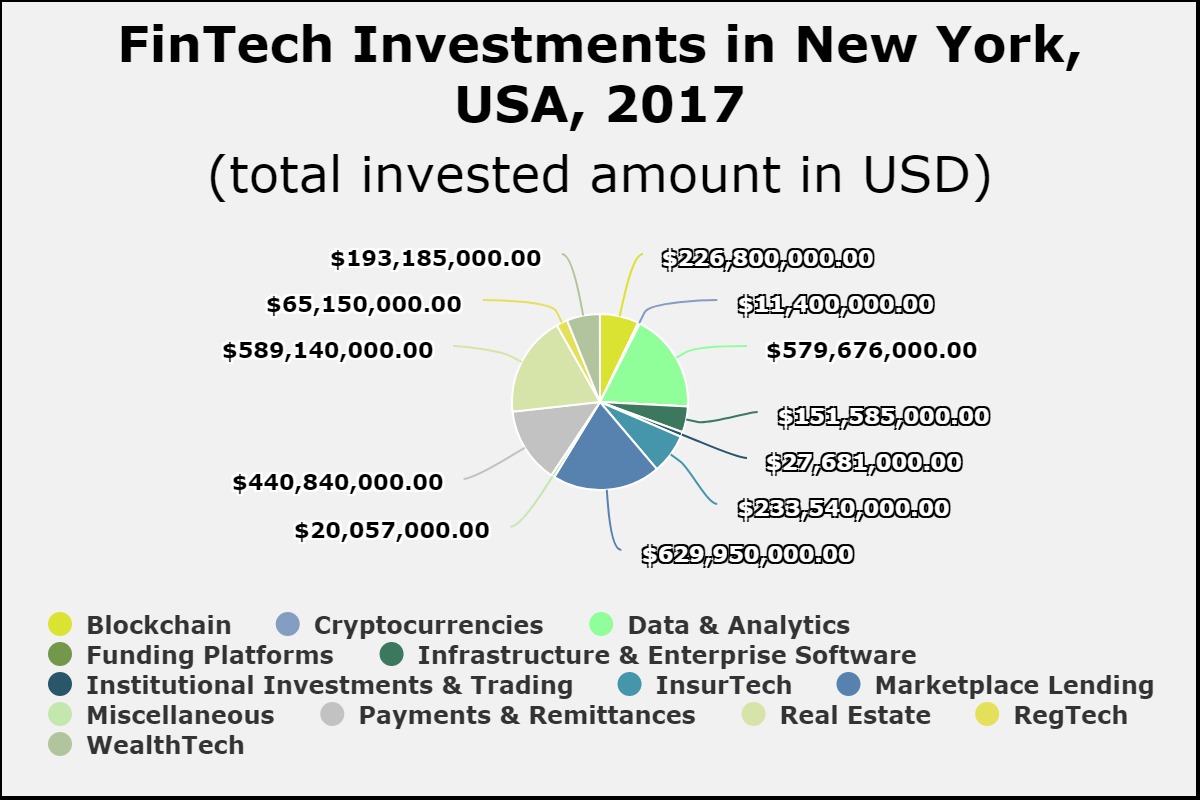

Last year, the majority of investments into New York-based FinTech companies went to those within the marketplace lending companies. According to data by FinTech Global, the infrastructure and enterprise software, which PIMCO is a part of, received 5 per cent of the capital deployed to the city, this is compared to the 20 per cent raised by marketplace lending companies.

Copyright © 2018 RegTech Analyst